TIME VALUE OF MONEY

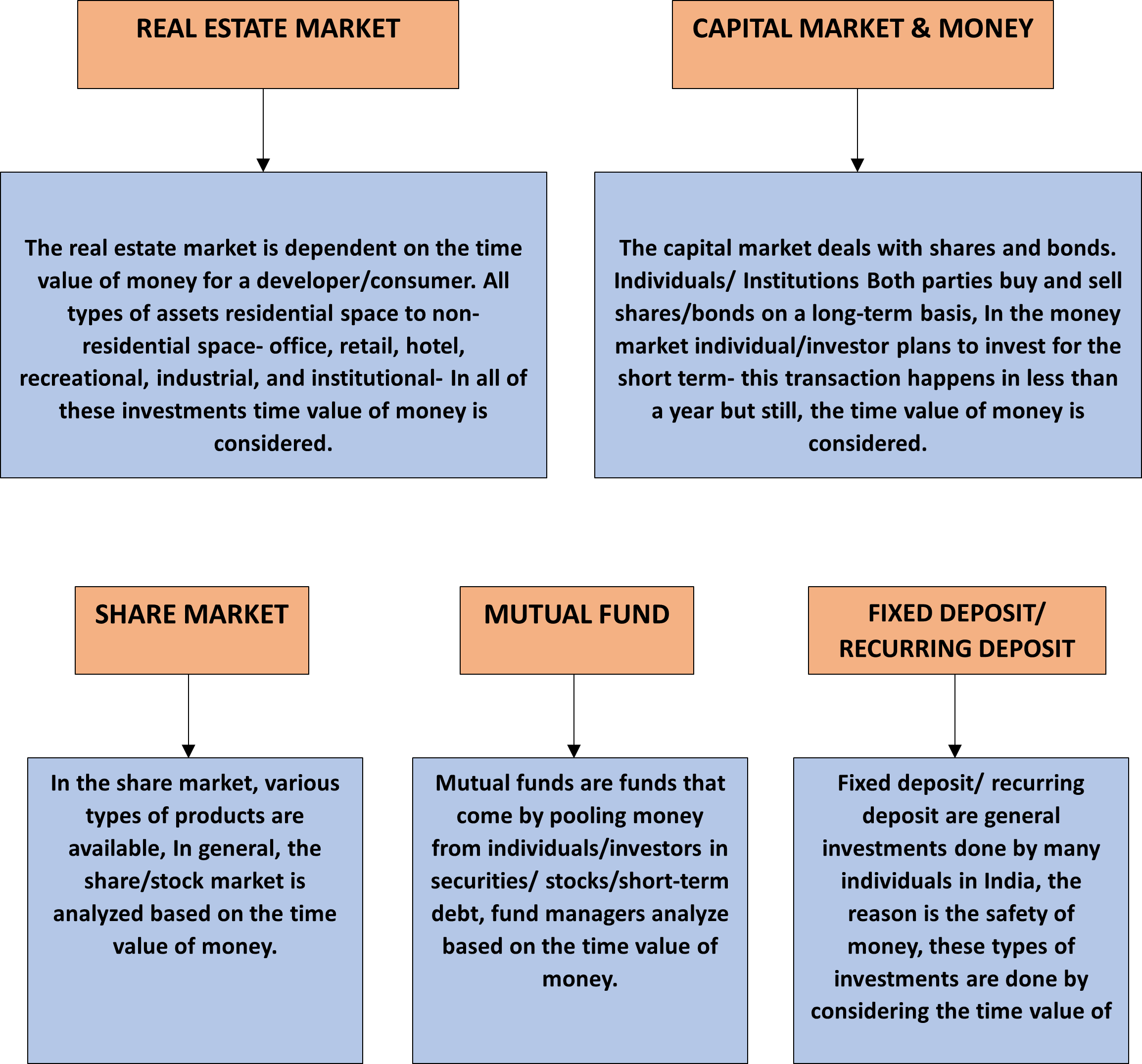

Real estate is all about the time value of money; much as fixed deposits and recurring deposits, which take a long time to mature, stock markets are equally crucial to this phenomenon.

The time value of money is everything in everyday life, we say, "We hope for this," and in the marketplace, "We hope for a good time value of money." In both places, we expect that we will earn profits in the future; thus, we take into account the discount rate, which is also determined by taking into account the weighted average cost of capital (WACC). WACC or the discount rate takes the project/company's risk into account.

Discount rates scientifically consider risk-free rates, which are inflation rate and risk premium, which is business risk, by calculating this we understand the market risk and our own business risk in the market, but it is done for today's market, for chasing the future market we go for discount rate as we consider the max probabilities of risk in it, more than that we consider various aspects of the market and many International/private consultancy firms advise on investments.

Like how we evaluate different rates when evaluating a real estate position, we do the same when evaluating a capital market and money market position. The two most important aspects are the time value of money and market transactions. Time value of money talks about the maturity period and pre-maturity period of stocks and bonds while market transaction highlights current market investments, foreign direct investment, and market trends.

Due to the current transactions taking place in the Indian market, the capital market is booming like anything right now. The political environment, trade policies, global politics, and foreign relations of countries all have an impact on the capital market.

Due to its short transaction duration and several problems that occasionally render the market wrong, banks are the primary participants in the money market.

All the markets considered above give details on how the time value of money affects investments, and cashflows are checked/considered for analyzing future potential. Market valuations are done based on future profits which are predicted based on the purpose of valuation, all this data is considered by one phenomenon which is the time value of money, the time value of money is considered for all the markets for checking gains.

Popular Searches:

Programmes - Construction Management Course | Masters in Construction Management in India | Construction Management Course in India | | MBA in Infrastructure Management | MBA in Real Estate Management | MBA in Real Estate Management | Real Estate Courses in India | Course Real Estate Management | MBA in Real Estate | Quantity Surveying | Quantity Surveying Courses | Quantity Surveying in Civil Engineering | Quantity Surveyor Course MBA Courses | BBA Real Estate

Admission - MBA Admission | BBA Admission | MBA Admission Process | BBA Admission Process | MBA Admission 2024 | BBA Admission 2024

Others - Courses for Civil Engineering | Project Management Salary | Construction Project Manager | Business in Real Estate | MBA Courses | Business in Real Estate |