Developer investment has always been crucial because it has various business aspects. Developer funding for projects comes in many forms, as listed below.

Land acquisition (Initiation to completion of project)

Partnership with Landowner- Space share/revenue share agreement basis

Investor at Project

Various risks are analyzed based on the above three points on developer investment.

Investment risk

Construction approval risk

Operational risk

Finance risk

Bank risk

Land Acquisition Route

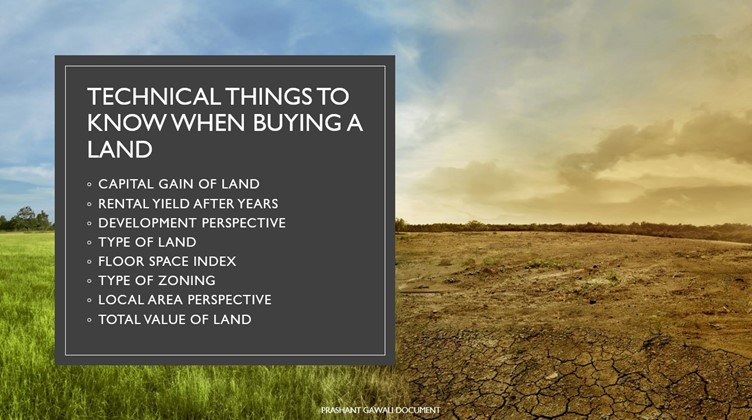

When a developer considers developing a real estate asset, the first thing that will likely cross his mind is land acquisition. Since land acquisition requires numerous permits and surveys, the developer will need a team to complete the job. The countless analyses are based on investment risk analysis and business-oriented for growth and profit-making that must be performed to acquire land successfully are listed below:

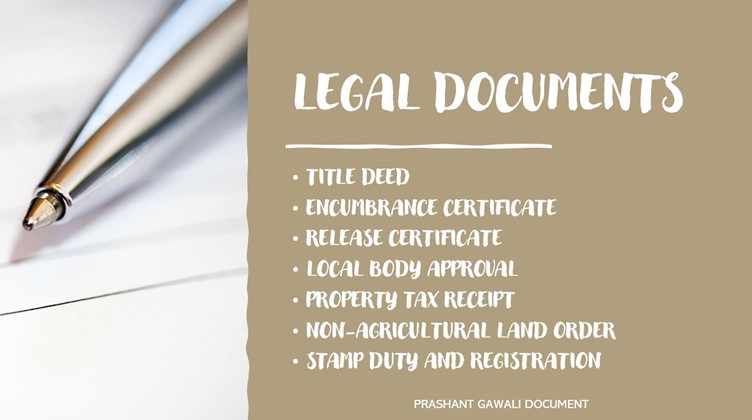

Following are some legal approvals that should be verified for property ownership as the developer completes the technical aspects of the project before investing.

After completing the legal requirements, the developer is ready to begin the project. Throughout the process, the developer will continue to invest in the project as sales are generated, rolling the money back into his company. Most importantly, the developer maintains a debt and equity model project in which, hypothetically assuming, he invests 40% in the project, and the remaining 60% is debt. Initially, the developer funds the project, and according to project sales, he puts money; the bank transfers funds quarterly by handing the project over to a third party for checking of work, the bank receives the lender's independent report, and, on that basis, bank disburses the amount.

Developers typically project profits of 15% to 20%, with a 10% to 15% risk component. Project profits usually rise over time as the value of new properties rises. Developers take losses into account when calculating risk. If the transaction is locked due to various factors, the developer must assess potential losses and consider inflation and expected investment return rates. If a market obstacle arises, the developer will ask for a bank overdraft; collateral will be taken for the bank's protection in such situations.

Partnership with Landowner Route

Developers work in collaboration with landowners to avoid the entire land acquisition process, and they agree on the following vital points:

Power of attorney

Profit share- Space share/ revenue share

Risk factor

Agreement tenure dates (Disbursement of profit till date/ Compensation in case of a profit-sharing concern

Sales projection

Method of the transaction (Profit sharing)

Investor at Project Route

Being an investor in a project is a wise decision because risk, investment, and profits can all be measured.

As the initiation/planning/execution/monitoring & controlling/closure process is a crucial job that requires inspection, operational risk will be constant for all three routes.

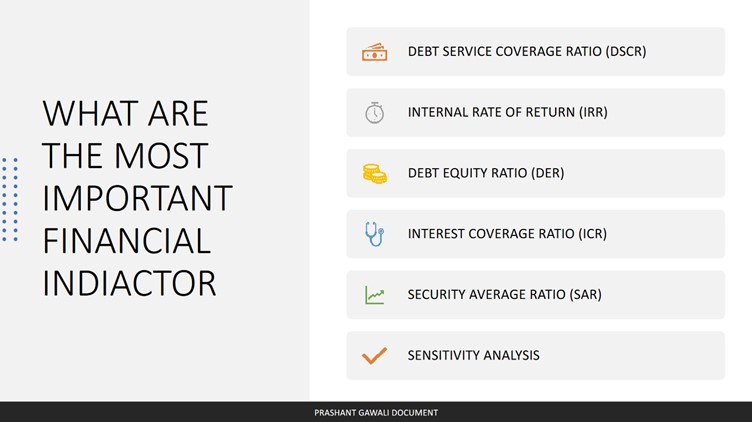

As the bank also considers risk, they examine several variables to determine whether a project will succeed. Financial risk factors are listed below:

Bank Perspective

The bank keeps track of construction risk, so the factors listed below are essential to the bank.

Consultant and contractor details

A detailed schedule of the project with a completion date for the project

Structural stability

i) Actual progress

ii) Financial progress

iii) Physical progress

Provision for cost escalation and contingencies

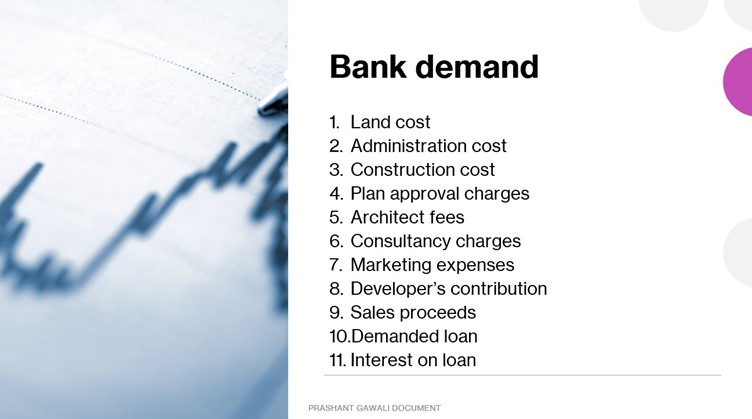

Generally, banks need details on where funds are going. In such scenarios bank analyses the following points given below:

Mr. Prashant A. Gawali

MBA in Construction Project Management

(2021-2023)

Popular Searches:

Programmes - Construction Management Course | Masters in Construction Management in India | Construction Management Course in India | | MBA in Infrastructure Management | MBA in Real Estate Management | MBA in Real Estate Management | Real Estate Courses in India | Course Real Estate Management | MBA in Real Estate | Quantity Surveying | Quantity Surveying Courses | Quantity Surveying in Civil Engineering | Quantity Surveyor Course MBA Courses | BBA Real Estate

Admission - MBA Admission | BBA Admission | MBA Admission Process | BBA Admission Process | MBA Admission 2024 | BBA Admission 2024

Others - Courses for Civil Engineering | Project Management Salary | Construction Project Manager | Business in Real Estate | MBA Courses | Business in Real Estate |