Evolution of REIT in India

India saw its first Real Estate Investment Trust (REIT) listing in April 2019 and second during the Pandemic lockdown in Aug 2020. It was lapped up by the investors both retail and institutional; domestic and international alike despite challenges being faced by Indian real estate sector over the last few years. It is an indicator of the potential of REIT in India. It is a testimony of investor appetite for such stable and diversified asset based investment preference in India backed by strong inflow of global capital being put up in core and development of commercial assets in India.

However, India has taken quite some time since December 2008 when SEBI first proposed it followed by SEBI (Real Estate Investment Trusts) Regulations, 2014 and time to time amendments made by SEBI between July 2016 and March 2019. The introduction of changes in taxation in recent years with introduction of Business Trust, easing of tax reforms for REIT, partial pass through status to REIT income, recognising Registered Valuer in Companies Act 2013, allowed FDI through ‘investment vehicles’, RBI allowed ECBs by including in ‘eligible borrowers’, SEBI allowed to issue listed debt securities etc., have provided impetus to it and has timely supported the reality of REIT in India. Although India has joined the global REIT operated countries like US, UK, Australia, Japan, Singapore, Hong Kong, etc., it has a long way to go before it catches up with the depth and spread of REIT in these countries.

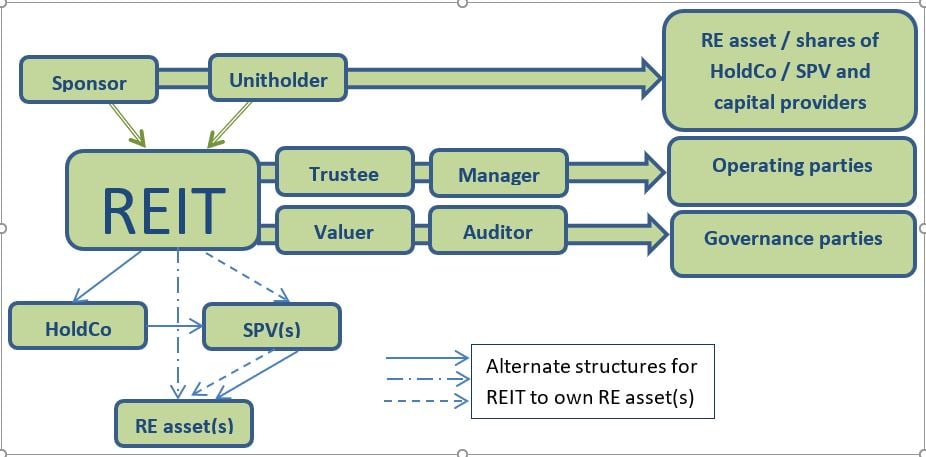

REIT structure and relevant norms in India

[1] As per SEBI (Real Estate Investment Trusts) Regulations, 2014 [last amended on 22 April 2019]

Eligibility and governance norms

|

Party |

Sponsor |

Trustee |

Manager |

|

Value of REIT assets |

INR 500 crs |

NA |

NA |

|

Experience |

At least 5 years in development or fund management in RE industry |

Registered with SEBI, not an associate of sponsor or manager and has infrastructure, personnel etc. to the satisfaction of SEBI |

At least 5 years in fund management, advisory services or property management in Real Estate industry Minimum two employees with above experience At least 50% of directors or governing Board members be independent |

|

Networth |

INR 20 crs each with INR 100 crs on collective basis |

Not prescribed |

INR 10 crs |

|

Investment & lock in period |

After initial offer, hold at least 25% of total units for three years (one year for exceeding 25%) and at all times, hold not less than 5% by each with not less than 15% on collective basis |

Not allowed to invest in units of REIT in which it is a Trustee |

NA |

|

Rights & responsibilities |

Set up the REIT, appoint Trustee, transfer entire shareholding or interest in SPV to REIT, arrange another person to act as re-designated sponsor |

Hold asset in the name of REIT, appoint manager & obtain quarterly compliance certificate, review transactions & ensure it at arm’s length basis, make distributions, review of unitholders complaints and its redressal |

Make the investment decisions, appoint valuer, auditor, RTA, management of RE assets, responsible for offer document, listing of units, make disclosures to the unitholders, SEBI, trustees, stock exchanges, declaration of NAV |

Investment norms

Initial offering norms

Other norms

Valuation norms

Taxation norms

|

Transaction |

Party(s) |

Taxation norms |

|

Transfer of RE asset / Shares of HoldCo / Interest in LLP by Sponsor to REIT against Units of REIT / Cash |

Sponsor |

|

|

Transfer of Shares of SPV by Sponsor to REIT against Units of REIT |

Sponsor |

|

|

Rental income from Lessee(s)

|

REIT |

Exempt |

|

SPV(s) |

Taxable |

|

|

Dividend from HoldCo / SPV |

REIT |

Exempt |

|

SPV(s) |

|

|

|

Unitholder |

Taxable Not taxable if SPV does not opt for Sec 115BAA |

|

|

Interest income from HoldCo / SPV

|

REIT (SPV is Co.) |

Exempt |

|

REIT (SPV is LLP) |

Taxable |

|

|

Unitholder (SPV is Co.) |

Taxable |

|

|

Unitholder (SPV is LLP) |

Exempt |

|

|

Dividend from domestic cos (other than from SPV) |

REIT |

Taxable Not taxable when such dividend income is received post 1 April 2020 and on which the company has paid DDT |

|

Sale of listed equity shares or MF units

|

REIT |

|

|

Buy back unlisted domestic co (including SPV) shares |

REIT |

Exempt |

|

Any other income |

REIT |

Taxable |

|

Distribution by REIT to Unitholder

|

REIT |

|

|

Unitholder |

|

|

|

Sale of Units of REIT (assuming held as capital asset by Sponsor / Unitholder)

|

Sponsor |

|

|

Unitholder |

|

Note: 1. Contents mentioned in italics and red font is as per the Finance Act, 2020

2. The table depicts the tax provisions for salient transactions specific to REIT structure

Finance Act 2020 while passing the Finance Bill by Parliament, has played balancing act in taxability of dividend i.e. either tax free dividend to unitholders or concessional corporate tax structure to the SPV. The provision of WHT by SPV while paying dividend to REIT leads to additional cash flow leakage as it’s an exempt income to REIT. Thus, partial taxation of dividend to unitholders and WHT by SPV on dividend to REIT may take away the competitiveness of REIT and may adversely impact the yield of its investors. Further, it may require revisit to the structuring strategies as it requires careful consideration of residency status of its various classes of unitholders and equity component in the SPV by REIT.

Suggested way forward

Regulators and policy makers may consider below mentioned points for making REITs more robust in India:Taking realty to next level

Indian real estate sector is currently facing crisis of confidence more than any other challenges. This scenario is prevailing despite positive milestones like RERA, demonetisation, GST implementation etc. Riding on the tech enabled disruptions, the Indian real estate sector is witnessing a significant rise in investments flowing to tech-based real estate start-ups in construction technologies (ConTech); property technologies (PropTech); digital business platforms, and ‘shared economies’ based real estate models. New age technologies such as Internet of Things (IoT), automation, cloud, artificial intelligence (AI), big data, augmented and virtual reality (AR/VR), blockchain and drones are increasingly finding applications across real estate business platforms.

Realty developers have tweaked their business models to adapt to newer trends like co-working places, co-living residences, student housing / accommodation and senior citizen living in the Indian real estate sector. These trends have emerged out of the very challenges experienced by them – the significant one being alternate avenues for public investment and capital / finance at reasonable cost of funds coupled with their aspiration to turn realty into service sector. Recent transactions flow depicting chase of global tie ups & capital infusion into these trends are proving potential lying in it.

Globally REIT prevails in various sectors like diversified, Residential, Retail, Office, Industrial, Healthcare, Self-storage, Lodging / Resorts etc. and the fact that no penetration as of now in India as it has its two Office REITs launched in April 2019 and Aug 2020. It is witnessed that all these trends are stable revenue generating propositions and its inherent need for sustainable capital. REIT offers the perfect fit for this as it requires such assets in its main play and provide capital with institutional and public participation. Eventual offloading the developed and income generating asset into REIT at valuation can provide timely capital replenishment and lean balance sheet structure to the developers. To operate in such unconventional way may hopefully help developers designate them as pure service providers and continue their march towards evolving more such trends and take realty to the next level.